2017 Global Distributed Control Systems Company of the Year Award

Background and Company Performance Industry Challenges

In 2016, the automation market was beset by several challenges, such as the plunge in oil prices, the economic slowdown in China, policy uncertainty caused by the new government in the United States, and political unrest in the Middle East. With the global investment climate improving following a rise in oil and commodity prices, there is new interest in automation projects that will boost production capacity and improve productivity. End-users are now looking for opportunities to evaluate their automation systems in light of recent advances in engineering methods, automation, and the connectivity provided by commercial information technology and the Industrial Internet of Things (IIoT), rather than simply returning to the methodologies of the past such as upgrading to the latest version of a control system provided by the current automation vendor.

The process industries’ production assets have never been larger or more complicated, and with increased scale and complexity, there is a growing inability to predictably deliver capital projects on schedule and within budget. In this scenario, the primary concern of the end-users lies in deploying their resources in a cost-effective way and attaining high capital efficiency. This cannot be achieved by just squeezing prices. It requires new methods of executing projects and new ways of looking at things. The attempt to reduce project costs adds pressure to automation costs, which is a prime challenge to the growth of Distributed Control System (DCS) vendors. DCS vendors that address this challenge through the use of innovative technologies in the field of cloud engineering, digital marshaling, virtualization, and automated data management are expected to gain a competitive advantage.

Visionary Innovation & Performance and Customer Impact

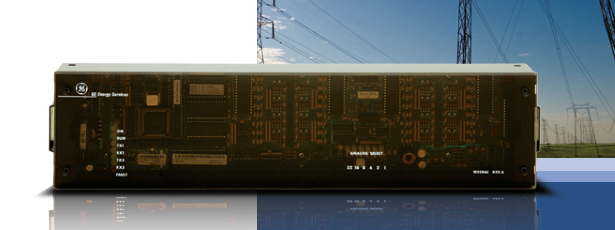

Connecting 70 million smart devices through 70,000 control systems, ASEA Brown Boveri (ABB) has one of the largest installed bases of process automation systems when compared to other automation vendors. ABB has been on the leading edge of efforts to streamline the design and delivery of digital automation systems and minimize the associated project risk since its establishment in 1988. As end-user projects get bigger and more complex, the financial risk posed by the inability of end-users to execute projects as planned has intensified over the past several years. This is especially true in the oil and gas segment and power segment, which are more capital intensive compared to other industrial sectors

ABB aligns with market Mega Trends and develops industry-specific DCS solutions to address the demands of different end-user market segments. ABB’s product solution targets Mega Trends such as Urbanization and Innovation to Zero across the end-user industries, enabling them to create new opportunities and values for their customers. This has helped ABB to stay ahead of competition and retain a leadership position in the DCS market. With market growth drivers such as increasing demand to implement advanced control strategies, the need for software-based services, value-added services (including upgrading cyber security, consulting, and training), and optimizing lifecycle costs are

expected to be intact in the short term. ABB is well positioned to retain its leadership position in the future as it is primed to deliver value to its clients in this market

Addressing Unmet Needs

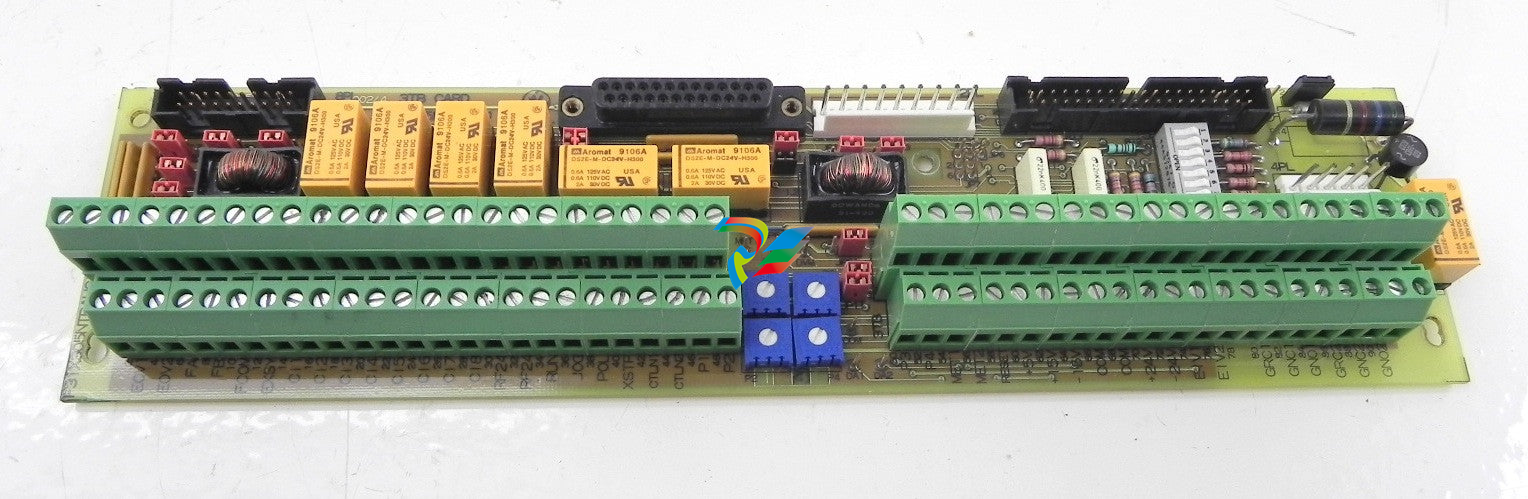

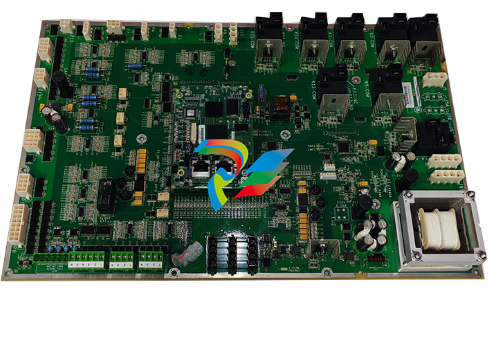

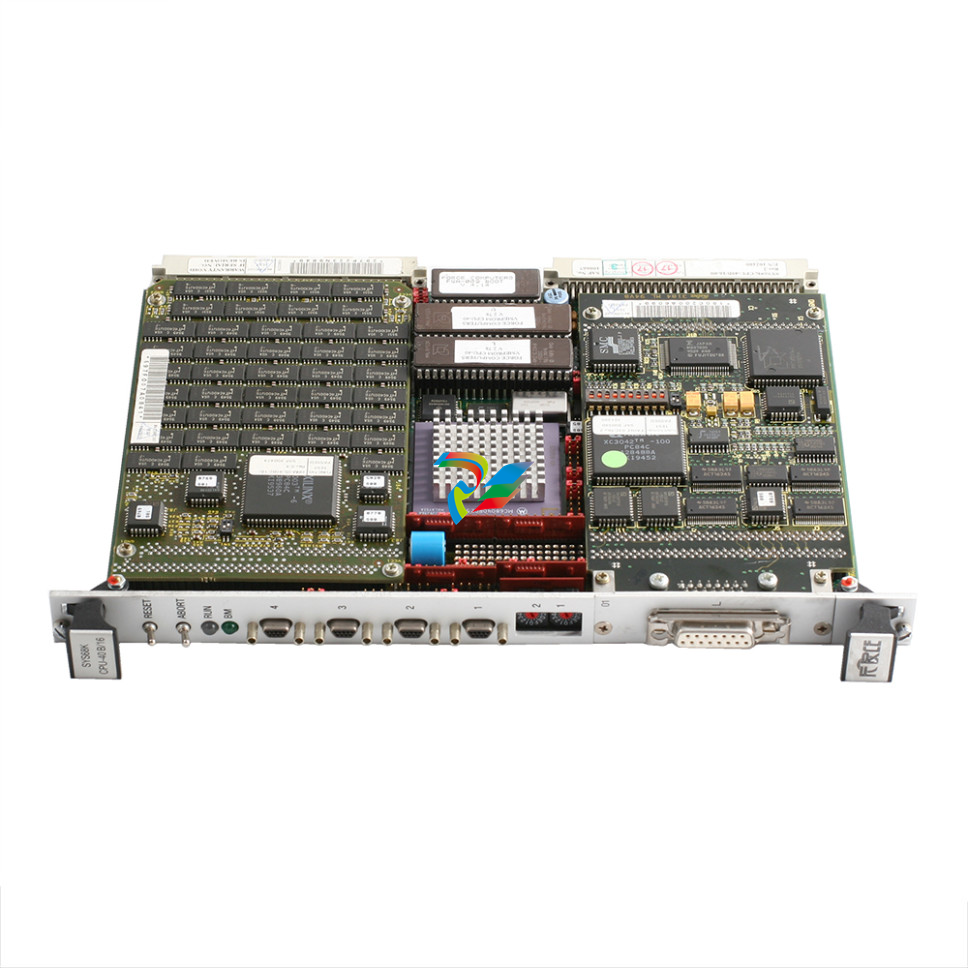

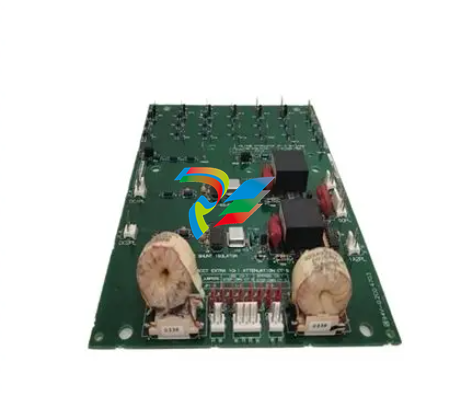

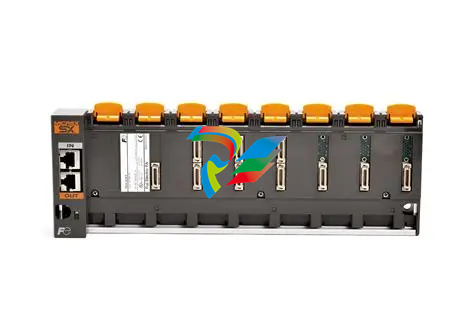

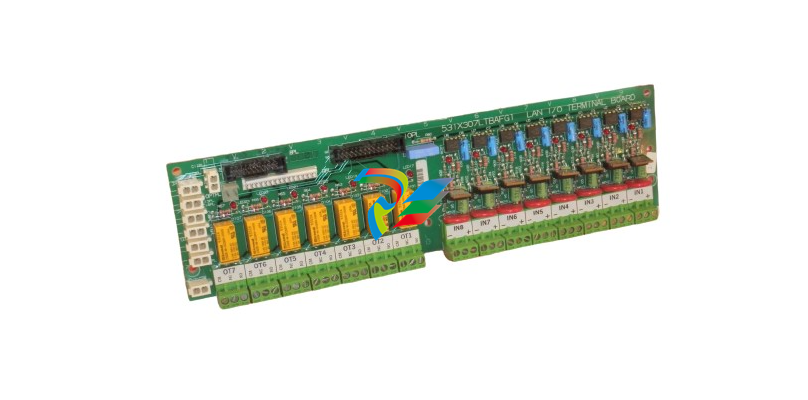

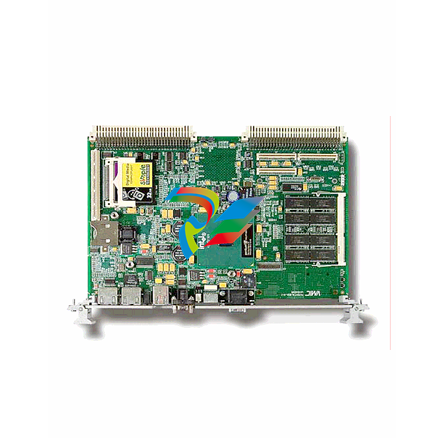

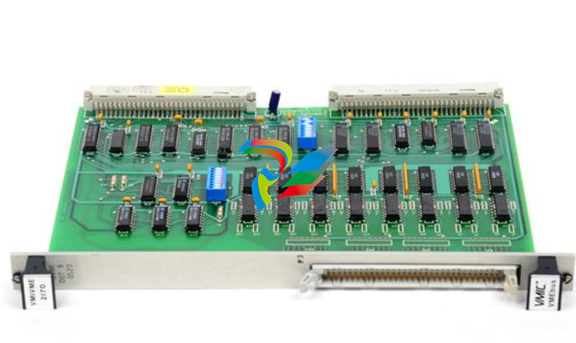

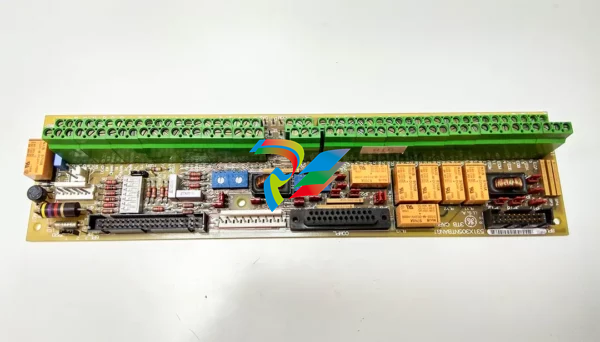

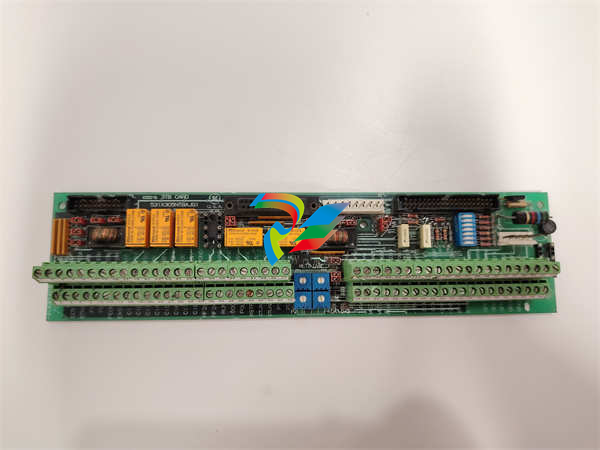

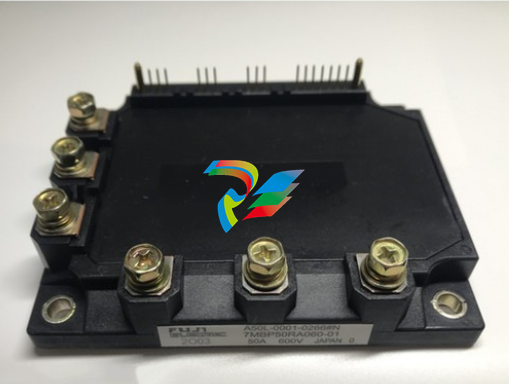

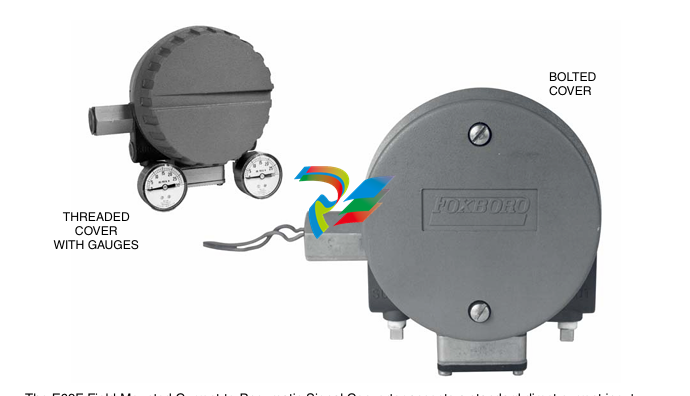

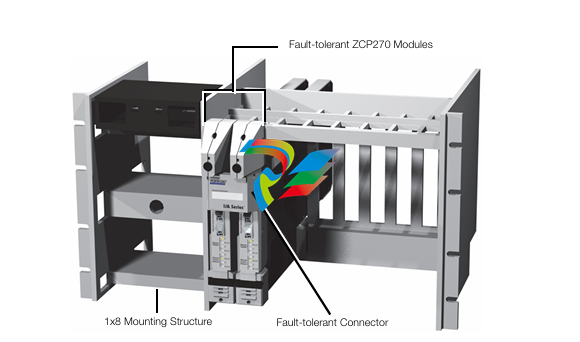

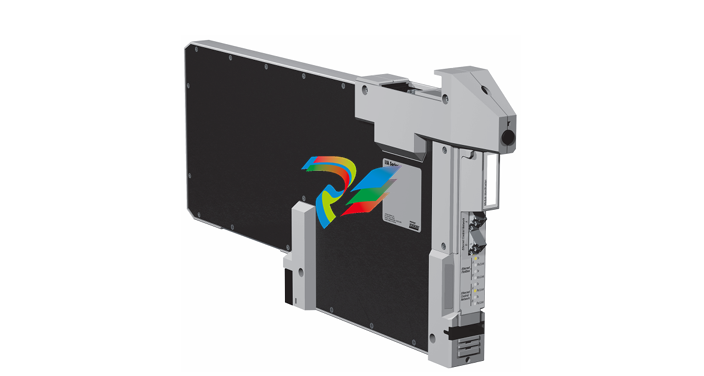

The increasing scale and complexity of automation projects has made it almost impossible to deliver capital projects on schedule and within budget. A key contributor to the growing risk of missing DCS project deadlines include late design changes, which tend to cascade throughout a project. A significant unmet need in the market is decreasing the dependency of the automation design on the process design. ABB took a significant step forward in streamlining the execution of its customers’ automation projects with the release of its Select I/O, an Ethernet-based single channel I/O solution for the ABB Ability™ System 800xA. This can be configured in the field to address the growing demand for full redundancy down to the signal conditioning module. Because the base hardware for every type of signal is the same, Select I/O effectively allows each I/O channel to remain flexible and “undeclared” until very late in the project, often up until just before commissioning. This effectively decouples I/O hardware engineering from software design, which lowers development costs and shortens the delivery schedule. The Select I/O, when coupled with the process know-how of ABB, improves the efficiency of DCS project execution and provides ABB a distinctive advantage in the DCS market with respect to competition.

Visionary Scenarios through Mega Trends

The concept of a connected industry is increasingly becoming a reality as industries, such as oil and gas, chemicals, power, pharmaceuticals, steel, water, mining, food, and beverage, move towards a digital operating environment to improve connectivity, productivity, and cost-effectiveness. The recent launch of the ABB Ability platform in 2017 will provide ABB with a competitive edge over its competitors because it provides unified, cross-industry digital capability—extending from device to edge to cloud—with devices, systems, solutions, and services. While similar competitor offerings allow end-users to sense, analyze, and take actions to drive efficiency, ABB has added self-learning capabilities to its solution that allow it to harvest data, take control, and enable users to do more. This distinguishes ABB from the rest of the competition in the market.

.jpg)

.jpg)

.jpg)

.jpg)

.png)

.jpg)

.jpg)

_lVjBYb.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)