Welcome to the October 2024 recap of the Manufacturing ISM Report On Business®, a comprehensive overview of the manufacturing industry based on input from supply executives across the U.S.A.

In October 2024, the manufacturing sector in the United States contracted again for the seventh time in a row. The Manufacturing PMI® (Purchasing Managers’ Index) was 46.5%, a 0.7 percentage point (PP) drop from September’s 47.2%, and the lowest this year. The overall economy stayed in expansion, as indicated by a PMI of over 42.5%.

U.S. Manufacturing Stats October 2024

| Index | Description | October 2024 % | September % | PP Change |

| Manufacturing PMI | An indicator of the overall direction of economic manufacturing trends | 46.5% | 47.2% | -0.7 |

| Backlog of Orders | The volume of orders awaiting fulfillment by manufacturers | 42.3% | 44.1% | -1.8 |

| Employment | Changes in employment levels in manufacturing | 44.4% | 43.9% | +0.5 |

| New Export Orders | The volume of new orders for export-bound goods | 45.5% | 45.3% | +0.2 |

| New Orders | The volume of new orders received by manufacturers | 47.1% | 46.1% | +1.0 |

| Imports | The volume of imports | 48.3% | 48.3% | 0 |

| Inventories | The level of raw materials and finished products in stock | 42.6% | 43.9% | -1.3 |

| Production | The level of production activity among manufacturers | 46.2% | 49.8% | -3.6 |

| Prices | Changes in input prices manufacturers paid for raw materials and other commodities | 54.8% | 48.3% | +6.5 |

| Supplier Deliveries | The speed of deliveries from suppliers to manufacturers | 52% | 52.2% | -0.2 |

Trends in Manufacturing

There were 11 industries that contracted in October compared to five that showed growth. Like last month, there were also several commodities in short supply, and some price increases.

Industries in Growth/Contraction October 2024

| Growth | Contraction |

| Apparel, Leather & Allied Products | Textile Mills |

| Food, Beverage & Tobacco Products | Printing & Related Support Activities |

| Petroleum & Coal Products | Transportation Equipment |

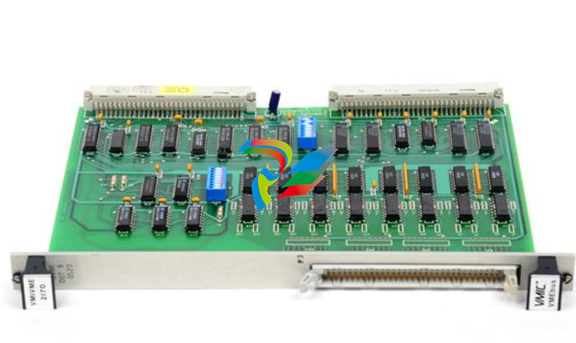

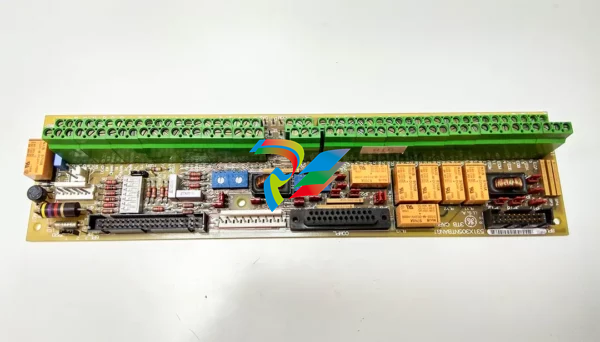

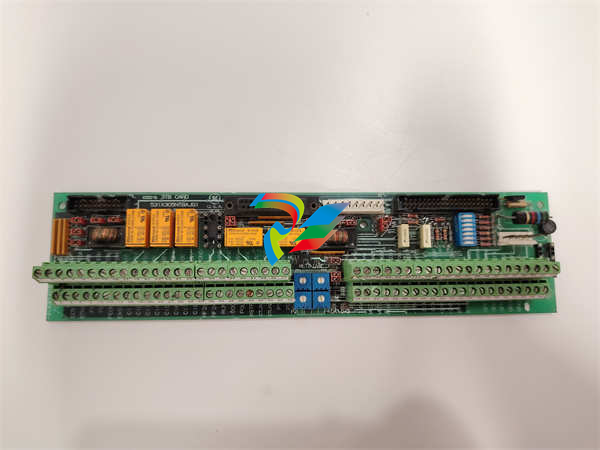

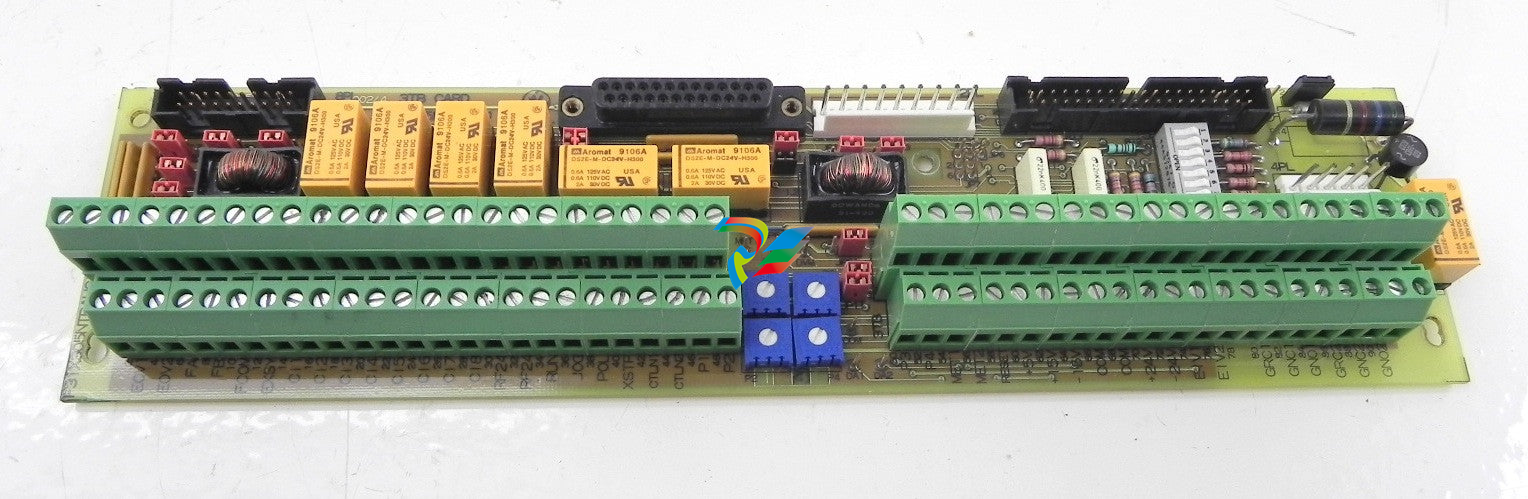

| Computer & Electronic Products | Chemical Products |

| Miscellaneous Manufacturing | Electrical Equipment, Appliances & Components |

| Machinery | |

| Primary Metals | |

| Nonmetallic Mineral Products | |

| Plastics & Rubber Products | |

| Fabricated Metal Products | |

| Paper Products |

Commodities October 2024

| Increased Price | Decreased Price | Short Supply |

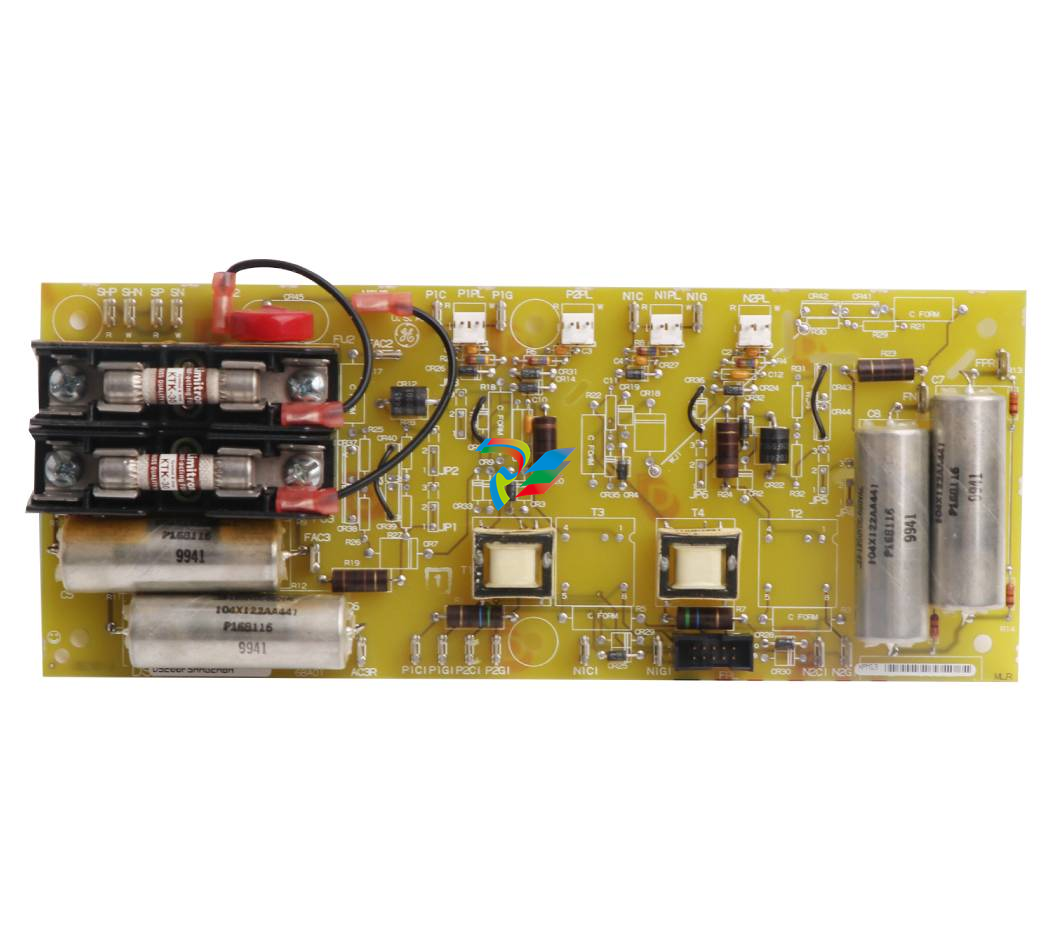

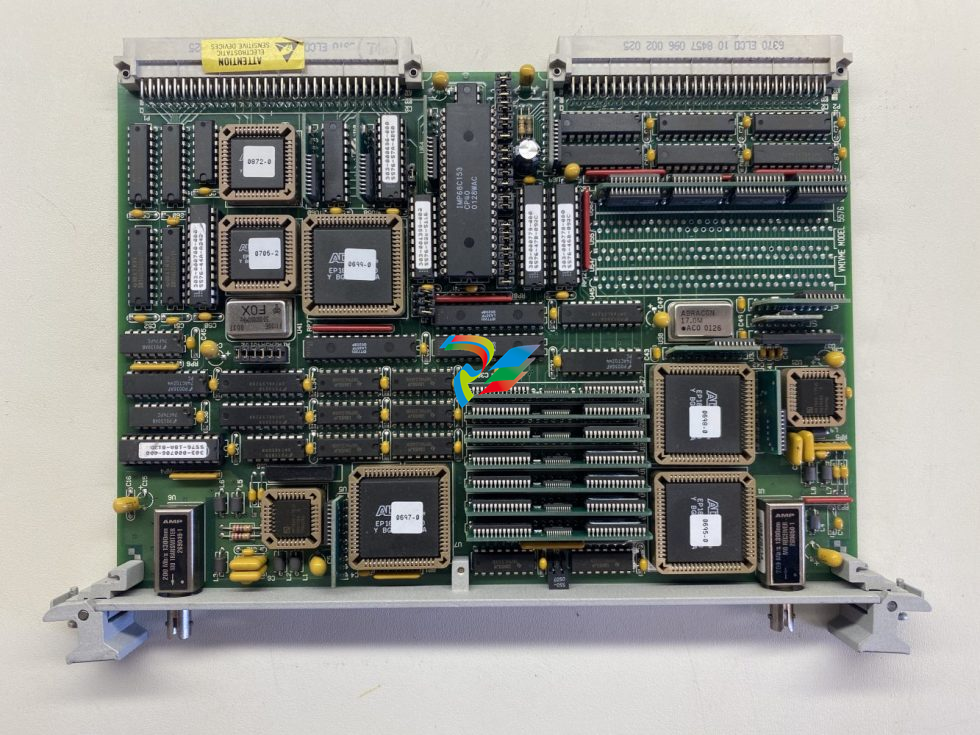

| Aluminum | Polypropylene | Electrical Components |

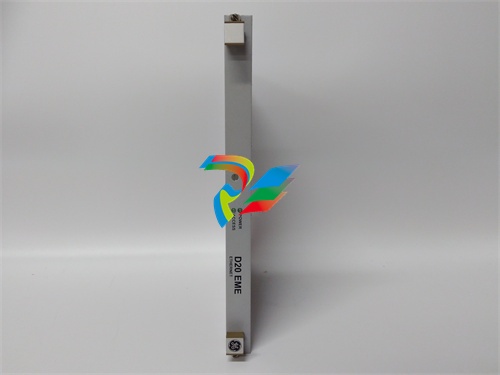

| Copper | Steel | Electronic Components |

| Corrugated Boxes | ||

| Crude Oil | ||

| Natural Gas | ||

| Paper | ||

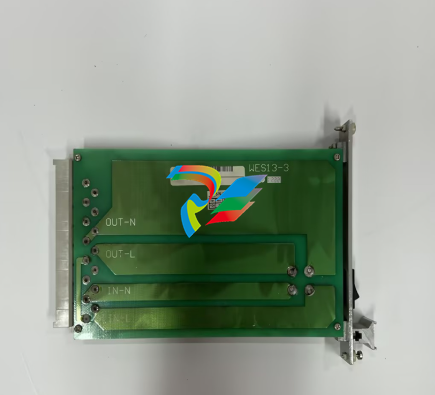

| Printed Circuit Boards | ||

| Road Freight | ||

| Sulfuric Acid |

U.S. Manufacturing October 2024—Summary

The U.S. manufacturing industry continued its contraction for the seventh month in a row—and faster than it did last month. At 46.5%, this was the lowest percentage reading of 2024. The month saw weak demand, declining output, but accommodative inputs. The slow demand was evidenced by the contracting New Orders, New Export Orders, Backlog of Orders, and Customers’ Inventories indexes. The declining output could be seen from the contracting Production and Employment indexes.

Eleven industries reported contraction, the top three being Textile Mills, Printing & Related Support Activities, and Transportation Equipment. Prices for raw materials, like aluminum, and copper, also went up. The Supplier Deliveries Index showed slower deliveries, just like last month. Encouragingly, a few industries, including Food, Beverage & Tobacco Products, and Computer & Electronic Products, reported growth.

The ISM Report on Business is issued monthly by the Chair of the ISM® Manufacturing Business Survey Committee, Timothy R. Fiore, CPSM, C.P.M., and can be found at ismworld.com.

Image Credit: ismworld.org

.jpg)

.jpg)

.jpg)

.jpg)

.png)

.jpg)

.jpg)

_lVjBYb.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)